salt tax limit repeal

Since the SALT cap was put into place however very high earners have seen a sharp reduction in the deduction as a percent of AGI from 77 percent in 2016 for those earning over 500000 to 071 percent in 2018. Certain members of the House and Senate want the SALT deduction cap removed which would benefit primarily higher earnersand result in a 380 billion reduction of federal revenue.

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

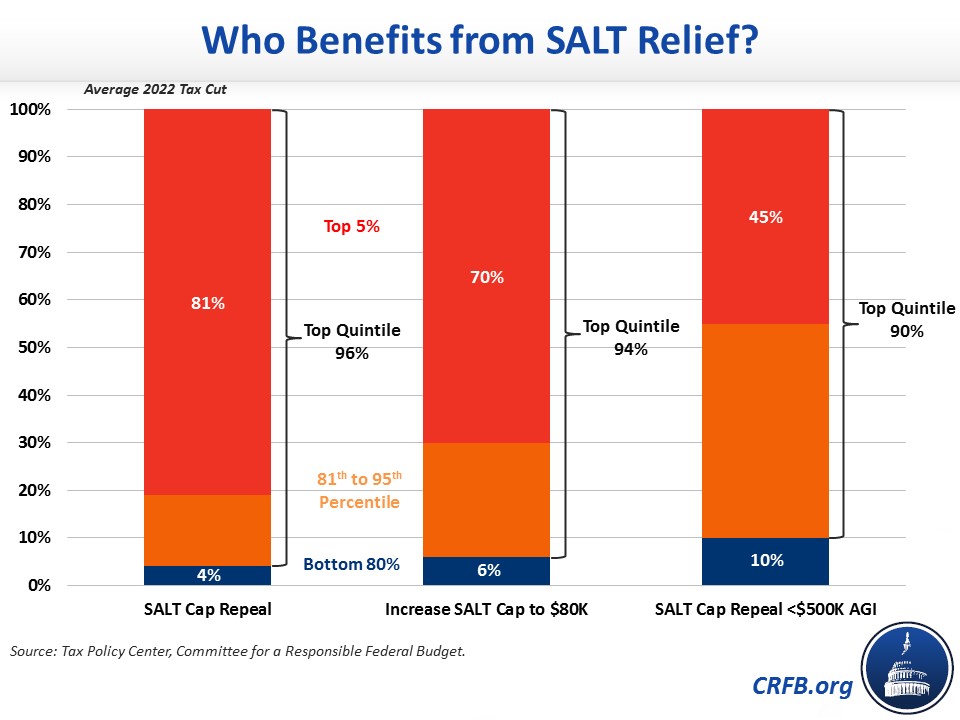

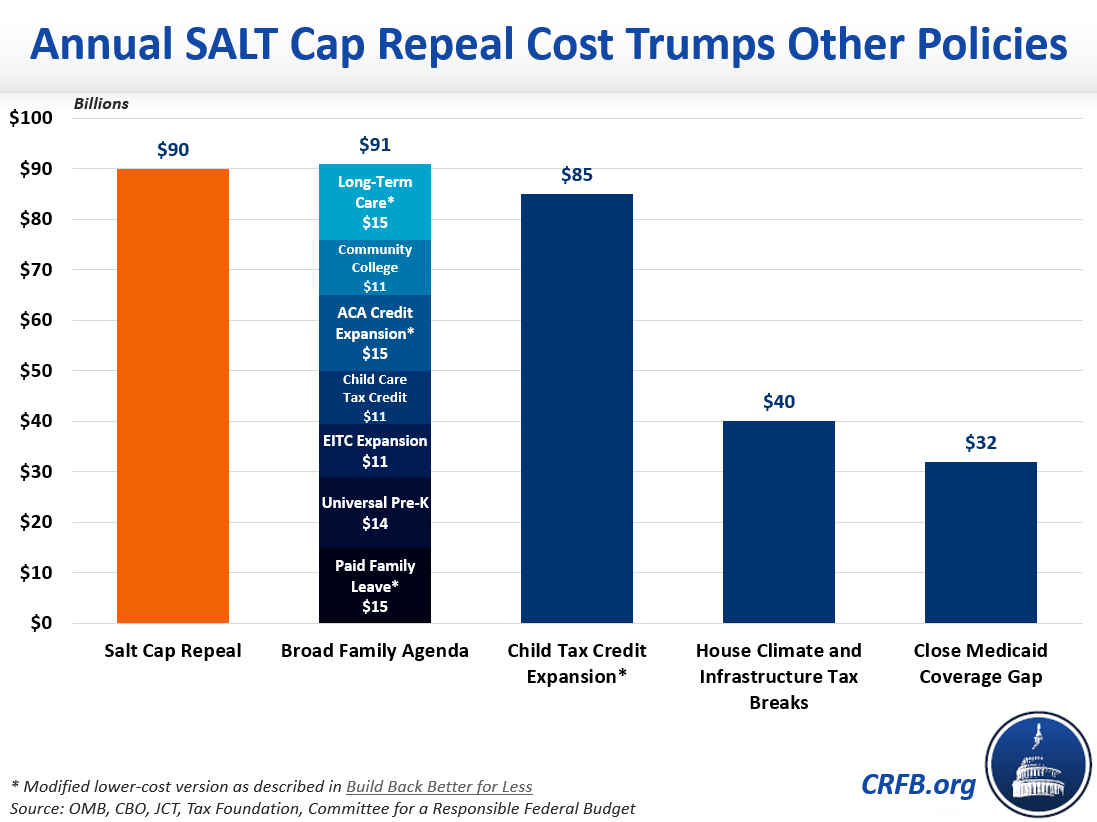

Such a plan would be still be very costly and regressive.

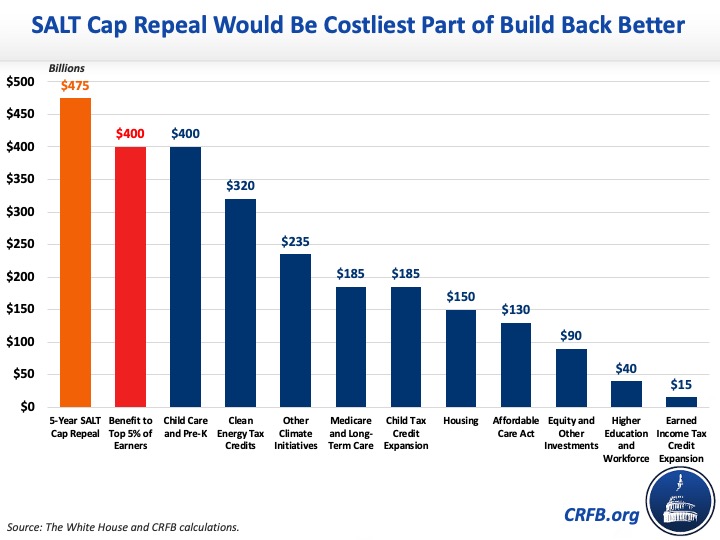

. The SALT cap repeal would also be one of the more expensive portions of the Build Back Better bill costing the US. The so-called SALT deduction cap which is poised to sunset in 2026 limits the amount of state and local taxes that Americans can deduct from their federal taxes to 10000. Finally the TCJA also put a new limit of a 10000 cap on SALT deductions reducing its value for many taxpayers.

Joe Manchin D-WVa says he wont vote for the. The TCJA also repealed the Pease limitation for tax years 2018 through 2025. While Congress has stalled on passing legislation that would eliminate in whole or in part the current limit on an individual taxpayers ability to take the itemized deduction for state and local taxes California has taken a dramatic step toward allowing many of its.

Biden did not propose a repeal of the 10000 SALT deduction cap which limits the amount of state and local taxes that can be deducted before paying federal taxes as part of his social spending. According to media reports Democratic negotiators are working on a repeal of the SALT deduction cap for up to five years which would cost 475 billion and give the richest 5 400 billion in. Some House Democrats have threatened to block Build Back Better if the broken-up package drops relief for the 10000 limit on the federal deduction for state and local taxes known as SALT.

By capping the SALT deduction at 80000 a wealthy taxpayer paying the top federal rate of 37 would get at most 25900 in tax. Raising or repealing the 10000 limit on the SALT deduction a change imposed by the 2017 Republican tax overhaul is one of the most politically charged aspects of the negotiation. That should spell the end for the SALT deduction a benefit for.

SALT Repeal Just Below 1 Million is Still Costly and Regressive. Since the day it was enacted lawmakers from the most affected jurisdictions have sought to repeal the provision which they insist unfairly burdens taxpayers in high-tax states such as New York Maryland and. 54 rows The value of the SALT deduction as a percentage of adjusted gross income AGI tends to increase with a taxpayers income.

If Congress decides to repeal the SALT deduction cap now the AMT and Pease limitation changes become more important. Dec 11 2021 Taxes. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT.

As Congress struggles to pass the Build Back Better bill some congressional Democrats are exploring new proposals to raise the 10000 cap on the state and local tax SALT deduction. July 29 2021. The 10000 annual limit on the state and local tax SALT deduction was one of the most contentious provisions of the 2017 Tax Cuts and Jobs Act TCJA.

On Tuesday Mr. Republicans passed the SALT Cap as part of the 2017 Tax Cuts and Jobs Act. And since the Tax Cuts and Jobs Act of 2017 filers who itemize deductions cant claim more than 10000 for SALT increasing levies for.

Blocking Threat Suozzi known as Mr. The so-called SALT deduction cap which is poised to sunset in 2026 limits the amount of state and local taxes that Americans can deduct from their federal taxes to 10000. Recently passed budget legislation in California will bring significant tax reductions to business and individual taxpayers.

To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households making below 900000 or 950000 per year. Most state PTET elections follow the standard workaround formula for the SALT cap which was introduced under the 2017 Tax Cuts and. D emocratic leadership outlined plans Monday to bypass GOP filibusters to alter the cap on deductions for state and local taxes paid a tax.

Without changes the current 10000 cap will expire after 2025. California Passes SALT Cap Work-Around. The bill would boost the limit to 80000 from 2021 through 2030 before dropping it back to 10000 in 2031.

The chief similarities between the SALT deduction limit and the CTC expansion are that both have run up against President Bidens 400000 pledge and encountered non-trivial intraparty head. Manchin told CNN that the Build Back Better bill is dead. August 9 2021 1133 AM 3 min read.

2 days agoAs discussed in Part I of this article at least 22 states have adopted a pass-through entity taxor PTETelection for small business owner taxpayers seeking to avoid the 10000 federal deduction limit for state and local taxes. SALT for his dedication to the issue said there are enough Democrats who will block the entire bill if the measure is not addressed. The Democrats plan to increase the federal deduction for state and local taxes known as SALT may be in peril as Build Back Better stalls.

SB 113 which Governor Gavin Newsom signed into law on February 9 2022 expands the states workaround of the federal deduction limit for state and local taxes SALT and repeals the net operating loss NOL suspension and business credit limits. As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions SALT is becoming an important part of the tax debate.

Dems Don T Repeal The Salt Cap Do This Instead Itep

Latest Proposal From Senate Democrats Would Bar The Rich From Salt Cap Relief Itep

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

New Report From Itep Describes Options For Changing The Salt Cap Without Repealing It Itep

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget